November 18, 2025

Top 50 Women in EF: Carolina Patiño on Automation & the Future Underwriting

A Leader Defining the Future of Equipment Finance

At Kin Analytics, innovation with purpose is our driver. That’s why we’re incredibly proud to celebrate that our Product Manager, Carolina Patiño, has been named one of Monitor’s Top 50 Women in Equipment Finance for 2025. This recognition is more than a personal accolade; it's a validation that data-driven vision, AI, and empathetic leadership are the keys to shaping the future of underwriting in the sector.

Carolina brings over a decade of experience translating complex data into effective business solutions. Her unique understanding of underwriting workflows and the operational bottlenecks lenders face daily fuels our strategy for Underwriting Automation Equipment Finance. Our goal: to reduce risk, drive efficiency, and elevate decision-making across the industry.

Decade of Impact: From Data Expertise to Product Leadership

Carolina’s journey, which led her from technical roles to Product Manager at Kin Analytics, is based on one principle: turning raw data into measurable value. Her transition into this role signifies a pivotal moment for our product strategy within the equipment leasing industry.

How Does Operational Experience Transform Underwriting Workflows?

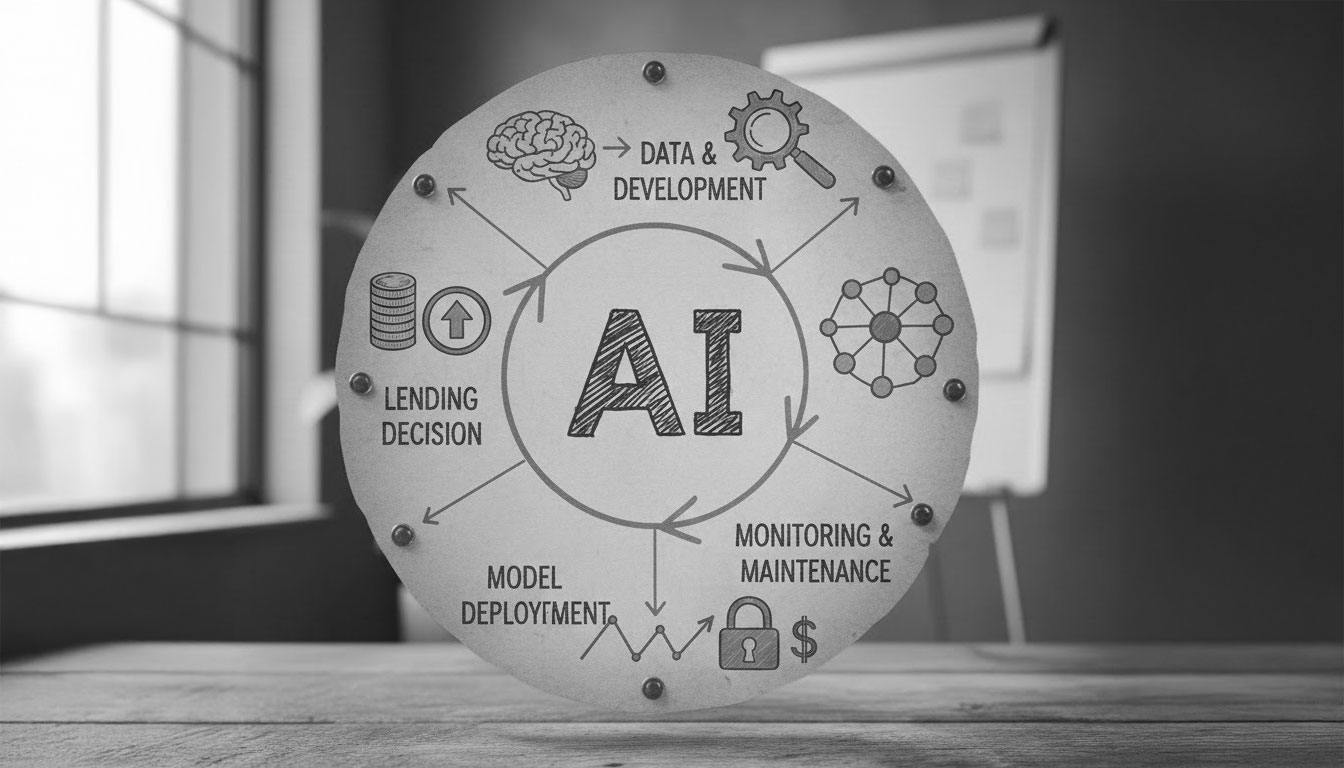

Carolina’s expertise is centered on an essential design triad for Underwriting Automation:

- Data & Technology: Advanced AI usage for information ingestion.

- Human Judgment: Empowering, not replacing, the analyst with tools designed for precision.

- Tangible Value: Focusing on solutions that simplify and deliver measurable results.

Kin Analytics explains that the most effective product leadership is achieved when operational friction points are deeply understood. By designing solutions that analysts want to use (intuitive and simple), we guarantee adoption and direct business impact.

The Success Story: 80% Faster Credit Application Submission

The true measure of Intelligent Automation is its result in efficiency. Carolina’s most impactful achievement was leading the development of a product that automates credit application submissions—one of the slowest tasks in credit origination.

What Is the Key to Reducing Submission Times by Over 80%?

Kin Analytics asserts that this staggering success rate—reducing submission times from inbox to CRM by over 80%—stems from continuous collaboration with lenders during design. This massive time reduction is due to two factors:

- AI Document Processing: Using Artificial Intelligence for data ingestion and validation, eliminating tedious manual data entry.

- Workflow Integration: Ensuring the solution is intuitive, eliminating operational bottlenecks common in U.S. equipment finance companies.

This milestone is the perfect case study demonstrating that speed and precision are compatible in Underwriting Automation Equipment Finance.

Authority Validated: Recognition by Industry Leaders

Carolina’s award is an external validation of Kin Analytics' impact on the industry's digital transformation.

Patricio Pazmiño, Chief Product Officer at Kin Analytics, reinforces this authority:

“Carolina stands out in our industry due to her unique blend of technical knowledge and hands-on expertise, which enables her to translate customer needs into high-impact solutions. She has immersed herself with operations teams from lenders to automate document processing and data intake using AI. Our customers have benefited greatly from her skill in converting business challenges into effective technical innovations.”

This endorsement is crucial, confirming that our expertise in AI in Credit Origination is recognized by industry leaders, positioning Kin Analytics, Redefining Equipment Finance with AI, as a sector innovator.

A Human Vision for the Future of Underwriting

Carolina’s recognition highlights the promise of the future of underwriting in equipment finance: a future forged by fresh perspectives, adaptive technology, and empathetic leadership driving meaningful change.

What Is the Role of Empathy in Process Automation?

In her own words, Carolina offers Kin Analytics' vision of the future:

“My advice is to let passion, empathy, and curiosity drive your work. Be open to learn and adapt while staying true to yourself in order to drive meaningful change. More than technology, it is the new faces with fresh perspectives and innovative ideas that make the future of the industry look bright and promising.”

This philosophy confirms that Underwriting Automation is a tool designed to be smarter, faster, and fundamentally, more human.

FAQ Block

What does the Monitor's Top 50 Women in Equipment Finance recognition signify?

This annual award recognizes 50 female leaders who have made exceptional contributions to the equipment finance industry, highlighting their leadership, innovation, and expertise. For Kin Analytics, it validates the high caliber of leadership driving our Underwriting Automation solutions.

How can my company achieve an 80% reduction in credit origination times?

The key is implementing Intelligent Automation solutions that tackle the biggest bottleneck: document ingestion and processing. By standardizing workflows and using AI to automate application submission (like the product led by Carolina Patiño), you can achieve an efficiency improvement of over 80%.

What role will AI play in the future of Underwriting over the next 5 years?

The future of underwriting with AI will not be replacement, but Augmented Intelligence. AI will manage repetitive, high-volume tasks (data intake, pre-screening), freeing experienced underwriters to focus their valuable human judgment on complex cases and exceptions, improving overall decision quality.

At Kin Analytics, Carolina Patiño's leadership and dedication reinforce our mission to transform credit origination: making underwriting faster and smarter. The recent news that Kin Analytics Appoints Petrie as Sales Lead further accelerates this vision.

The vision of an automated future is not a cold pursuit; it is the direct result of the empathy and curiosity of leaders who understand real operational needs.

If you are ready for your team to experience the same efficiency and future-forward vision in your Underwriting Automation processes, we are ready to collaborate.

Ready to cut credit application submission time by 80%? Request an automation demo with Kin Analytics.

/Like this post?

You’ll love our newsletter.

.png)

.webp)