December 2, 2025

Precision Credit Scoring: The Strength of Equifax Data and Kin’s Modeling Expertise

At Kin Analytics, our mission has always been to empower lenders with AI and predictive modeling. Today, we are pleased to announce a partnership with Equifax® that elevates our mission to the next level.

This collaboration combines our credit modeling expertise with trusted, comprehensive commercial data from Equifax, creating a powerful credit risk solution for commercial lenders. Together, we are enabling you to manage risk with unparalleled precision and confidently approve more of the right deals.

The Challenge: Data Gaps in Commercial Lending

For too long, commercial lenders have been forced to make critical decisions with an incomplete picture of the borrower. Missing information creates uncertainty, slows down the underwriting process, and can lead to missed opportunities with creditworthy applicants or unnecessary exposure to risk. Generic, one-size-fits-all credit models simply can’t account for the unique characteristics of your portfolio or your specific business goals.

Why We Partnered with Equifax

Advanced analytics and machine learning models are only as powerful as the data they are trained on. To build the most accurate and predictive models for our clients, we need the most robust and reliable data available.

That is why we chose to partner with Equifax. By integrating rich commercial credit data from Equifax, we can enhance your current borrower data, effectively filling the information gaps that limit and slow down decision-making. This partnership provides the high-quality "fuel" for our sophisticated analytics engine, allowing us to deliver richer insights and more accurate predictions than ever before.

A Tailored Solution for Your Lending Strategy

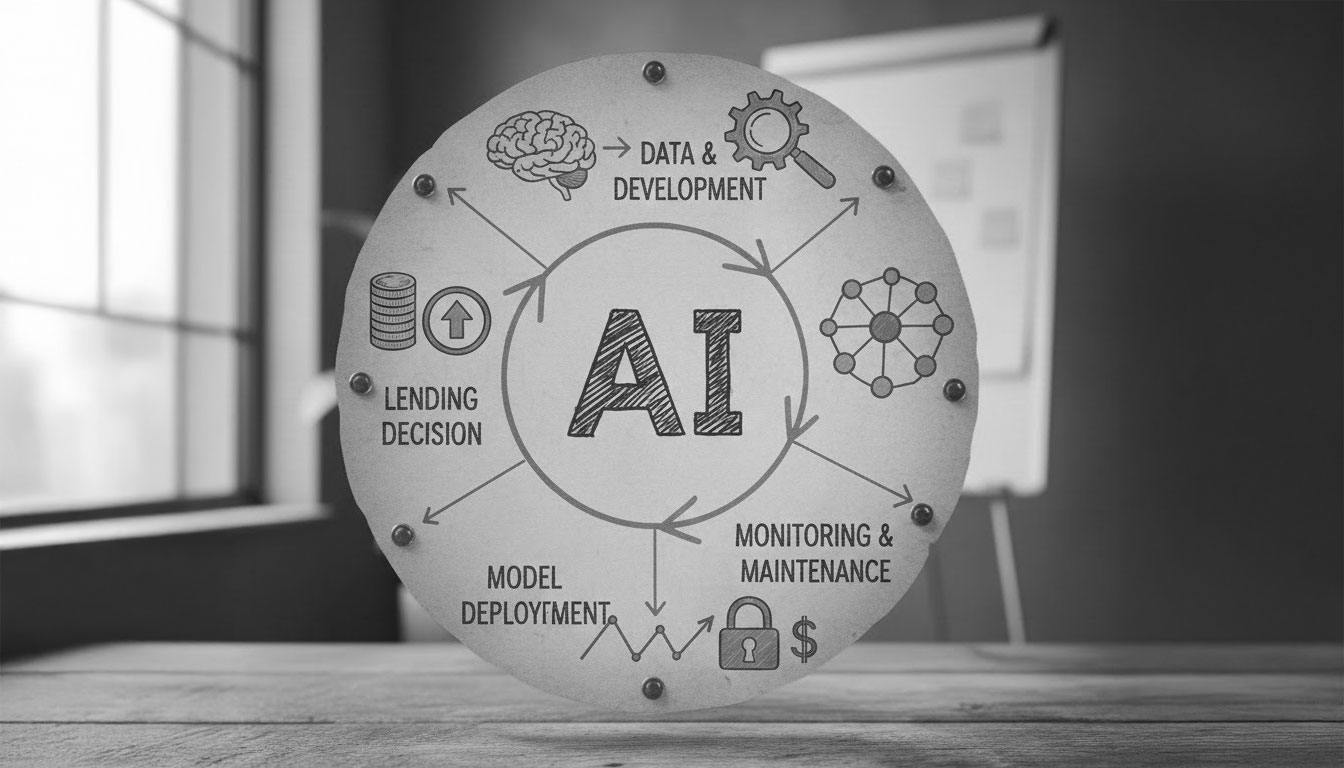

Our integrated solution is designed to deliver customized intelligence that aligns directly with your business objectives. Here’s how it works:

- Enrich Data: We start by enhancing your borrower data with extensive commercial information from Equifax.

- Develop Custom Models: Our team develops custom credit scoring models meticulously designed around your unique portfolio, risk appetite, and core business goals.

- Deploy Flexibly: You have the choice to use the solution directly within our intuitive platform or integrate it seamlessly into your own systems, ensuring a smooth fit with your existing workflows.

Proven Results, Tangible Impact

This isn't just a theoretical improvement. This powerful combination of premier data and tailored credit solutions delivers transformative results. Clients using this advanced approach have seen, on average:

- 30% increase in approval rates

- 20% reduction in default rates

- 50% reduction in underwriting time

By powering your decision-making with Kin Analytics custom models fueled by Equifax data, your team can confidently grow your commercial lending portfolio while maintaining robust control over risk.

The Future of Lending is Here

We are immensely proud of our expertise in building predictive solutions, with a track record that includes over 200 predictive models delivered and 120+ credit scoring models developed. This partnership with Equifax amplifies our capabilities, allowing us to provide a solution that delivers results for our clients.

We are excited to show you how this collaboration can directly optimize your underwriting process.

Ready to see the power of smarter credit risk assessment in action?

.webp)