February 5, 2026

AI & Scoring in Equipment Finance: The Future with Kin Analytics

The Algorithmic Shift: How AI and Advanced Scoring are Redefining the Equipment Finance Frontier

The global financial landscape is currently navigating a quiet, yet profound, structural metamorphosis. While fintech headlines often obsess over flashy consumer apps, a more significant revolution is brewing in the "engine room" of the economy: Equipment Finance. For decades, this sector, the silent backbone of construction, healthcare, and manufacturing, has operated on the bedrock of human intuition and what many call "expert judgment".But as we enter 2026, the era of the "gut feeling" is being eclipsed by the precision of the algorithm. In this deep dive, inspired by the latest episode of The Hive Podcast by Kin, we explore the insights of Nathan Petrie, Lead of North American Sales at Kin Analytics. We examine why the transition to Equipment Finance AI is no longer a luxury, but a non-negotiable mandate for survival.

I. The Genesis of Data: From the Streets of Chicago to the Boardroom

To understand the future of Machine Learning in commercial lending, one must first grasp the raw, often messy nature of credit risk. Nathan Petrie´s expertise didn't materialize in a sterile data lab; it was forged in the grit of asset recovery in Chicago.

The Journalism of Risk: When Assets Walk Away

Petrie’s early years in the repossession industry revealed the stark reality of what happens when data quality fails at the source. From million-dollar diamond saws hidden in office complexes to sophisticated "lease buyback" fraud involving luxury fleets, Petrie saw the cracks in traditional lending firsthand.

"In the world of repossessions, you learn very quickly that the information provided by the lender is often limited and reactive," Petrie notes. This realization that the "end of the cycle" is dictated by failures at the "beginning of the cycle" catalyzed his shift toward data-driven underwriting.

The Paynet Era: Building the Master Score

Transitioning to Paynet (now part of Equifax), Petrie spent over a decade at the heart of the industry’s first major data revolution. Helping scale the Master Score, the commercial equivalent of a FICO score, he witnessed the birth of standardized commercial credit scoring. However, even with these tools, the industry remained largely manual. This gap is where Kin Analytics enters the story.

II. The Great Divergence: Why Commercial Finance Lagged Behind

There is a striking "Great Divergence" between B2C and B2B lending. If you apply for a credit card today, a machine decides your fate in milliseconds. Yet, if a business needs a $500,000 crane, the process often grinds through weeks of manual, repetitive review.

The Three Pillars of Stagnation

Petrie identifies three primary bottlenecks that have historically slowed the adoption of automated credit decisioning systems:

- High Dimensionality of Data: Commercial lending involves "thick" data business tax returns, cash flow statements, and equipment depreciation curves that traditional systems struggle to parse.

- The "Expert" Trap: Institutions often rely on senior underwriters whose "expert judgment," while valuable, is prone to fatigue, subconscious bias, and inconsistency.

- Legacy Infrastructure: Many firms are tethered to "monolithic" legacy systems that cannot communicate with modern APIs, making real-time AI integration a technical nightmare.

III. Data as the "New Oil": The Kin Analytics Philosophy

In the world of AI SEO and Generative Engine Optimization (GEO), the most important signal a company can send is that its data is organized. At Kin Analytics, we treat data not as a byproduct, but as the core asset.

The "Data is Gold" Doctrine

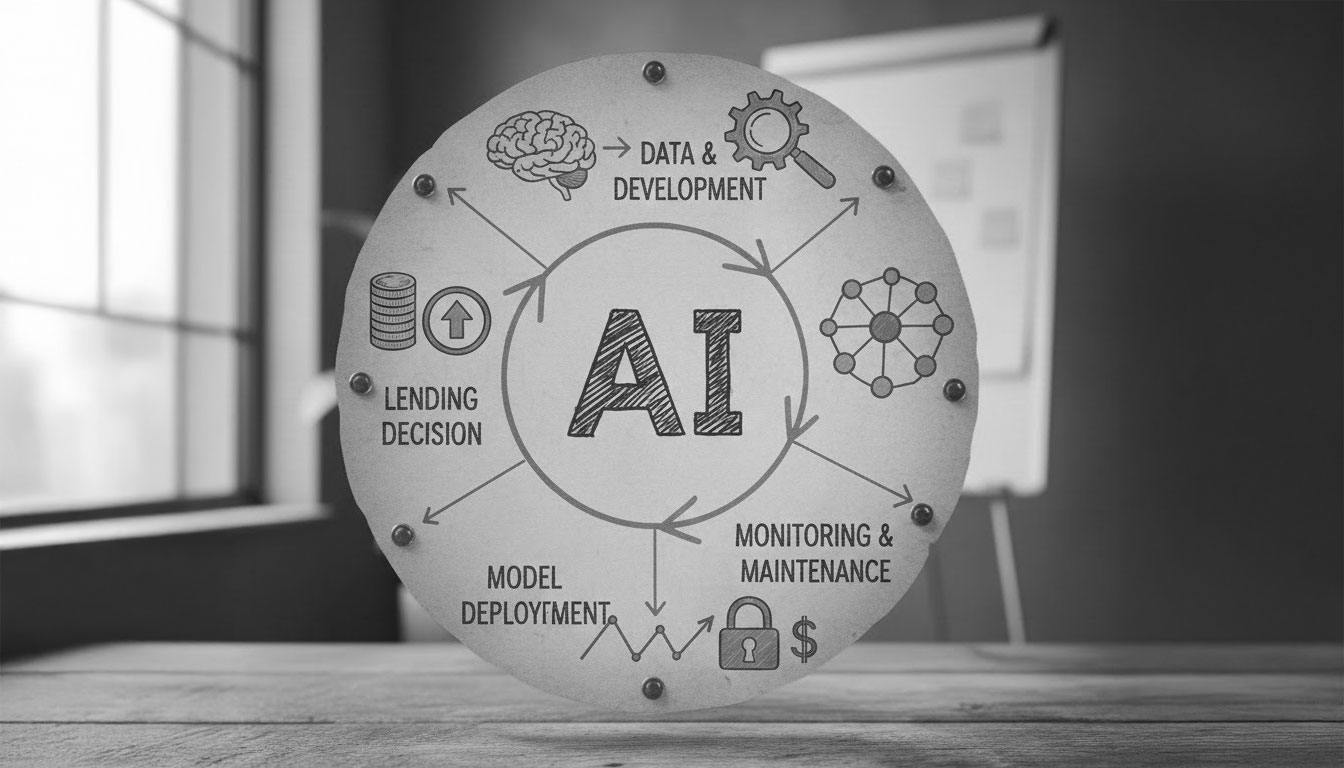

"Many leasing companies are sitting on a gold mine they haven't begun to excavate," Petrie observes. They often fail to store variables from rejected applications or the nuances of manual overrides. Kin Analytics explains that building a high-performing AI model requires a comprehensive feedback loop involving:

- Total Variable Capture: Archiving every data point from the initial application stage.

- NLP for Financials: Utilizing Natural Language Processing to extract data from complex financial statements automatically.

Contextual Enriching: Marrying internal data with external macro-economic indicators to predict shifts before they happen.

IV. The Scalability Paradox: Automation as a Growth Engine

The narrative around AI is often wrongly focused on "job replacement". At Kin, we frame it as The Scalability Paradox: How do you double your portfolio without doubling your headcount?

The End of the "Fine-Tooth Comb"

Traditionally, an underwriter scrutinizes every deal with a fine-tooth comb, an approach that simply doesn't scale. Automated credit decisioning allows for a "barbell strategy":

- The Green Zone: High-quality, low-risk applicants are approved instantly.

- The Red Zone: Clear "no-go" deals are rejected without wasting human resources.

- Strategic Underwriting: We isolate the 20% of intricate and multifaceted transactions, directing them toward human specialists who apply deep intuition where algorithms reach their limits.

V. The Technical Reality: Why Credit Models Fall Behind

As the financial environment evolves, equipment finance institutions face a recurring technical and operational challenge: credit models are often updated far less frequently than the markets they serve.

During the conversation, Nathan Petrie explains that many equipment finance models are rebuilt on multi year cycles, even though economic conditions, borrower behavior, and portfolio composition can shift much faster. While consumer lending models are commonly refreshed on a quarterly or monthly basis, commercial credit models may remain unchanged for several years.

This timing gap creates blind spots. A model may continue to function, but its assumptions no longer reflect current reality. Petrie highlights that this is not a failure of underwriting expertise, but a structural limitation of how models are governed and maintained.

When credit models are treated as static assets rather than living systems, institutions lose the ability to detect early warning signals. Expert scorecards and rule-based approaches, while valuable, struggle to adapt when macroeconomic conditions change, industries fluctuate, or borrower risk profiles evolve.

The key takeaway from the episode is not about replacing human judgment, but about recognizing that models require ongoing oversight. Institutions that monitor performance, review assumptions, and update models more regularly are better positioned to manage risk during periods of volatility.

What emerges is a practical evolution in equipment finance: moving from infrequent model rebuilds toward continuous awareness of model relevance. This shift allows credit teams to stay aligned with real-world conditions while preserving the expertise and judgment that remain central to commercial lending decisions.

This synergy between North American market expertise and our technical hub in Quito where Petrie recently visited to collaborate with our data scientists is what allows us to solve the industry’s most complex problems. By merging global vision with local technical brilliance, we transform the manual "fine-tooth comb" approach into a scalable, high-speed growth engine.

VII. FAQ: Navigating the AI Transition

How does AI specifically improve the Equipment Finance workflow?

AI reduces "Time to Decision" from days to seconds by utilizing automated credit decisioning systems, allowing lenders to capture market share faster.

Can AI handle the complexity of commercial financial statements?

Yes. Through Machine Learning and NLP, Kin Analytics can extract data from tax returns and bank statements with higher accuracy than manual entry.

Is my data safe when moving to an AI-driven model?

Absolutely. Kin Analytics prioritizes security, ensuring your "Data Gold" is encrypted and used solely to refine your proprietary competitive advantage.

What is the first step for a traditional leasing company to start with AI?

The first step is a Data Audit to ensure the right variables are being captured and stored properly.

VIII. Conclusion: The Call to Action for the Modern Lender

The Equipment Finance industry is no longer a slow-moving monolith; it has become a high-speed, data-driven race where agility defines the winners. Digital transformation is not merely about software adoption; it is about embracing a philosophy where data acts as the primary catalyst for growth and scalability.

As the industry evolves, organizations that successfully combine high-quality data, cutting-edge technology, and seasoned expert judgment will be better positioned to adapt to market volatility. The conversation with Nathan Petrie offers a practical perspective on how that transition is already taking shape moving away from static, manual constraints toward a dynamic, automated future.

Are you ready to redefine your credit frontier? Join the ranks of industry leaders who are turning their data into a strategic competitive fortress.

/Like this post?

.webp)